How to Read Mortgage Interest Rate Form

How to read a mortgage Loan Estimate (formerly a "Good Faith Estimate")

June 5, 2020

-

8 min read

Loan Estimates let you easily shop for mortgage rates

A Loan Estimate – formerly chosen a "Good Faith Estimate" – is the nearly important document y'all'll expect at when you store for a mortgage.

The Loan Gauge lists everything y'all demand to know almost a mortgage. It includes things like the interest charge per unit, upfront loan costs, and monthly payments, as well as a breakdown of your closing costs.

LEs always come up in the same format, making it like shooting fish in a barrel to compare rates and fees from unlike lenders side–by–side.

This lets you shop for a loan with complete visibility near how much it volition cost from any given mortgage company.

In this commodity (Skip to…)

- What is a Loan Approximate or "Skillful Organized religion Guess"?

- What's included in a Loan Guess?

- How to read a Loan Estimate: Page 1

- How to read a Loan Estimate: Folio two

- How to read a Loan Estimate: Page three

- How many days is a Loan Estimate skillful for?

- Does a Loan Estimate hateful you're approved?

- How authentic is a loan estimate?

- Total list of mortgage Loan Estimate definitions

- How to get a loan estimate

What is a Loan Estimate or "Adept Religion Estimate"?

A Loan Estimate (LE) is a standard document y'all'll receive when you apply for a mortgage with whatsoever lender.

This document used to be called a "Good Religion Approximate," simply was updated in 2015. The new version, chosen a "Loan Estimate," is easier to read and a more than useful tool for loan shoppers.

LEs always follow the same format – making it simple to compare loan offers side–past–side and discover out which visitor offers the best rates and fees.

Lenders are required to ship you a loan approximate within 3 days of you applying for a mortgage.

What is included in a Loan Approximate?

The LE is 3 pages long, split into sections which outline the terms, endmost costs, and fees associated with your loan.

Some of the items y'all'll discover listed on your mortgage Loan Estimate include:

- A summary of your loan details, which include your loan amount, the term of your loan, and your initial monthly payment

- Your escrow business relationship information, which includes your pro–rated annual property tax and homeowners insurance costs

- Your estimated loan endmost costs, including your lender fees, your title fees, and whatever tertiary–party costs apply

While it's important to empathise all the terms on your Loan Estimate, in that location are a few key sections you'll want to pay special attention to. Nosotros walk through those below.

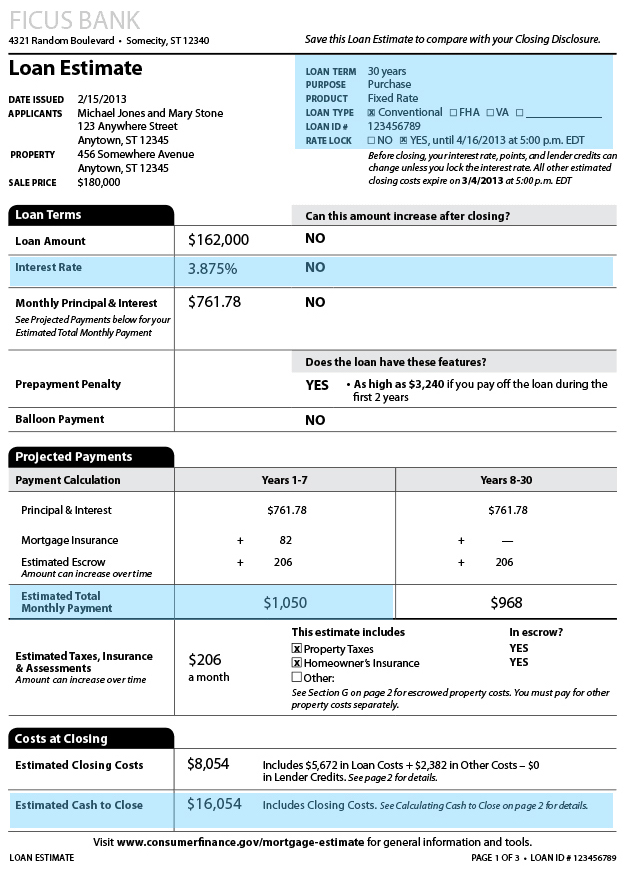

How to read a Loan Guess: Page 1

Page one of the Loan Estimate is an overview of your loan terms and costs. When y'all're comparing lenders, you lot'll desire to pay special attending to:

- Engagement issued – The LE is but binding to the lender for 10 days after this date. Y'all should also try to get all LEs on the same day, as rates alter daily

- Loan term and type – Make sure these are the terms you wanted, and that all LEs you lot compare prove the same information. Accidentally comparing a 15–twelvemonth loan to a 30–year loan, for example, would give you a skewed rate comparison

- Interest rate – Look for the lowest rate. But also pay attention to page ii, which shows you how much you have to pay (in the form of "points") to get that rate

- Estimated full monthly payment – This shows you lot how much you lot'd pay each calendar month with principal, involvement, taxes, and insurance included

- Estimated greenbacks to close – This number shows how much money y'all actually need upfront, including your downwards payment likewise as lender fees and third–party charges

Come across where you tin find these items beneath.

Source: The Consumer Fiscal Protection Bureau

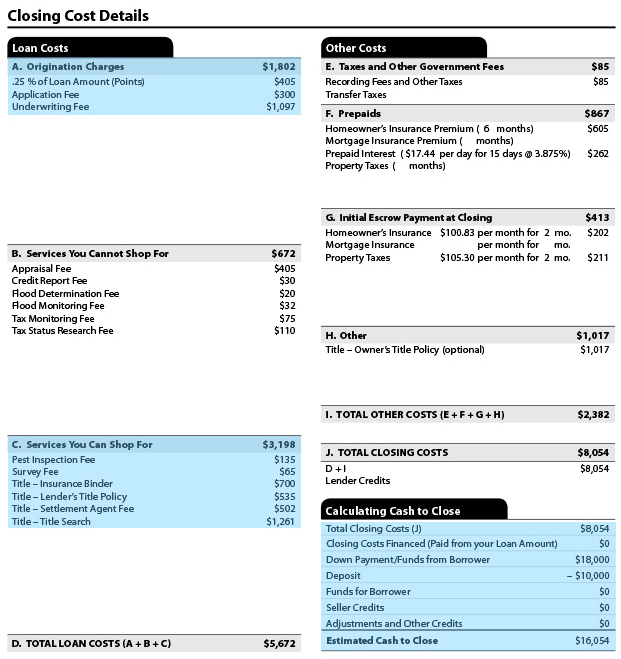

How to read a Loan Estimate: Page 2

The second folio of your loan estimate breaks downward the costs shown on the kickoff page. To better empathise your interest rate and fees, y'all should await at:

- Points – This shows the dollar corporeality you take to pay to "buy down" your interest rate, and actually receive the rate shown on page i

- Application and underwriting fee – Lenders all accuse different fees to process your loan. Consider what you lot're paying the lender upfront as well as your interest charge per unit

- Services you can shop for – These are third–party services. They're not set by your lender, but you're gratis to store for cheaper third–party providers

- Calculating cash to close – This box shows y'all a breakdown of the "greenbacks to close" shown on page 1

See where you can find these items beneath.

Source: The Consumer Financial Protection Bureau

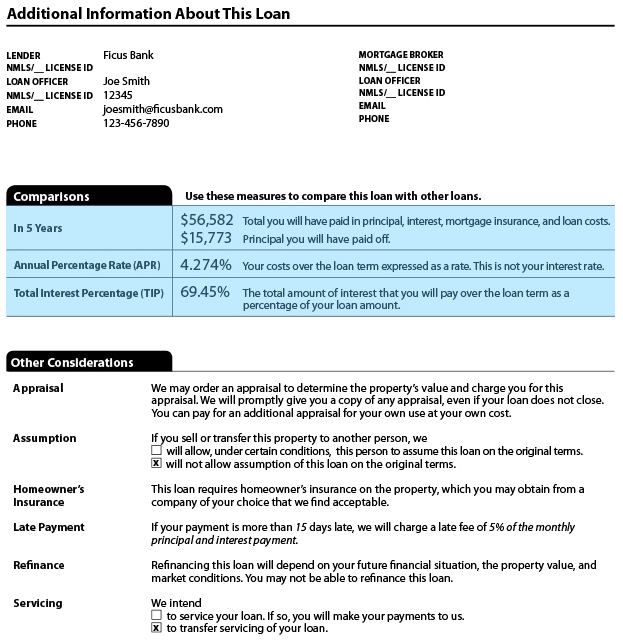

How to read a Loan Estimate: Page 3

Page three of the Loan Approximate has a few more cardinal numbers to help yous compare offers from different mortgage lenders.

- In 5 years – Shows how much y'all volition have paid altogether, and how much you will have paid off toward the loan residuum alone, in 5 years. This number is especially helpful if you don't plan to stay in the house a long time, as it helps you understand the weight of upfront costs vs. interest rate in the short–term

- April – Another manner to compare ii lenders' rates and fees combined. The APR represents your full loan costs over the life of the loan, including interest and upfront costs, expressed as an almanac percentage

See where yous can find these items below.

Source: The Consumer Fiscal Protection Bureau

How many days is a loan estimate skillful for?

These terms on a Loan Estimate are valid and binding for a period of ten days from issuance. That ways a lender must follow through with the charge per unit and terms offered on your LE if you move forward with the loan within x days – provided that there are no major changes to the loan or application.

Does a good religion estimate mean you're approved?

Receiving a Loan Estimate or "Expert Faith Estimate" does not mean you're approved for a mortgage. Every bit the CFPB puts information technology, "Loan Estimate shows yous what loan terms the lender expects to offering if you lot decide to move forward."

If y'all do move forward, you'll accept to provide additional documents proving your ability to repay the loan.

Remember, the Loan Estimate is issued based on an initial expect at your application. You tin can go an LE afterward providing but:

- Your name

- Your income

- The property address of the habitation you want to purchase/refinance

- The property's value gauge or purchase price

- Your loan amount

- Your Social Security number

Source: Quicken Loans

At the time a lender sends the Loan Guess, information technology hasn't yet seen all the documentation supporting those numbers on your application. In other words, your loan hasn't gone through full "underwriting."

If anything on your application can't exist fully documented (like your income, savings, debt, etc.), your loan terms are subject to change.

The terms on your LE are also subject area to change if there's a major change to your loan. For instance, if you change the term for 30 to 15 years or determine you desire an adjustable–charge per unit mortgage instead of a fixed–rate mortgage.

Only after the lender has fully reviewed all your documents will y'all exist officially "approved" for the loan.

How authentic is a loan guess?

Although it's just an estimate, the Loan Estimate is very oftentimes a reasonable approximation of what your loan will cost. This is because, by law, final loan costs must be inside ten percent of the costs shown on the original LE.

Chiefly, you lot should try to get all your Loan Estimates on the same day. That'southward because mortgage rates change on a daily basis. So if you lot look at different LEs from different lenders on dissimilar days, you lot're not actually comparing apples to apples quotes.

Full list of mortgage Loan Estimate definitions

Key terms on Loan Estimate page 1:

- Loan amount – The home price, minus your down payment

- Interest rate – Your annual interest rate expressed as a percentage of the loan corporeality

- Primary and interest – Your monthly payment to the mortgage company. Includes the corporeality paid toward your loan balance and interest paid to the lender

- Prepayment penalty – May be charged if you sell, pay off a big chunk of the loan balance, or refinance within the stated time frame. Not all lenders have a prepayment penalty

- Balloon payment – Well-nigh loans practice not have a airship payment. This is a special blazon of loan with lower initial payments, and a large lump–sum payment due at the end

- Mortgage insurance – Mortgage insurance is an boosted monthly charge, usually required if you put less than twenty% down

- Escrow – Typically, you pay taxes and insurance in monthly installments along with your mortgage. This money goes into an "escrow" account

- Taxes and insurance – What you owe for property taxes and homeowners insurance, divided by 12 to show a monthly charge

- Closing costs – Closing costs include all upfront fees charged past your lender and 3rd–party companies to corroborate, ready up, and fund the loan

- Greenbacks to shut – Greenbacks to close includes closing costs, plus your down payment; this represents the total amount you take to pay out–of–pocket at the endmost table

Fundamental terms on Loan Approximate page 2:

- Application fee – Fee to utilise for the mortgage. Many lenders do not charge an application fee

- Underwriting fee – Fee for the mortgage company to review all your documentation and officially approve you for the loan

- Services you cannot shop for – According to the CFPB, "The services and service providers in this section are required and called past the lender. Because yous can't shop separately for lower prices from other providers, compare the overall cost of the items in this section to the Loan Estimates from other lenders"

- Services you can store for – According to the CFPB, "The services in this section are required by the lender, but yous can relieve coin past shopping for these services separately. Along with the Loan Approximate, the lender should provide yous with a list of canonical providers for each of these services"

- Taxes and regime fees – The cost to legally transfer the title of the business firm/property to you

- Prepaids – Prepaid homeowners insurance (typically 12 months) due at closing, plus any prepaid mortgage interest

- Initial escrow payment at endmost – Your first few months' of homeowners insurance premiums and belongings taxes to be deposited into escrow, due at closing

- Closing costs financed – If any of your endmost costs are rolled into the loan balance, that amount will exist subtracted from your cash to close

- Deposit – Your earnest money eolith will be subtracted from your final greenbacks to close

- Lender credits – A rebate offered past the lender to reduce your closing costs. Usually, if there are lender credits, you lot're paying a higher interest charge per unit. Make sure you lot hash out this decision with your lender

- Seller credits – If you negotiated with the seller to pay part or all of your closing costs, that amount will exist subtracted from your greenbacks to close

Key terms on Loan Approximate page three:

- In 5 years – The total amount y'all'd pay toward the loan in five years, including principal, interest, mortgage insurance, and upfront costs

- Annual pct rate (April) – Your combined interest and loan costs, represented as a percentage of the loan corporeality. April is the effective almanac rate yous'd be paying if all costs were spread out over the life of the loan

- Total interest percent (TIP) – Your full interest cost if you were to pay off the loan in full, represented every bit a percent of the loan amount

- Late payment – Indicates whether or not there is a fee for being late on your mortgage payment, and if then, what the grace catamenia is

- Servicing – Indicates whether the lender will go on your mortgage or transfer servicing to another company. If information technology transfers servicing, the new visitor will handle payments and any modifications to the loan in the hereafter. Transferring servicing is the norm

How to get a Loan Estimate

If yous don't have a home picked out yet, a mortgage lender is likely to give you a "quote" – a non–bounden approximate of what your loan might look like.

If you do have a dwelling picked out, y'all tin consummate a mortgage application and go an official Loan Guess within three days.

An LE is free (aside from a potential credit check fee), and gives you all the information you need to find the best mortgage deal.

Popular Manufactures

- Your Guide To 2015 U.S. Homeowner Tax Deductions & Tax Credits Oct viii, 2015

- Minimum FHA Credit Score Requirement Falls 60 Points Oct eleven, 2018

- Fannie Mae HomePath mortgage: depression down payment, no appraisal needed, and no PMI Jan 23, 2016

- Fannie Mae's mandatory waiting menstruation after defalcation, short auction, & pre-foreclosure is simply 2 years Dec 11, 2018

- Gift letter of the alphabet for mortgage: How to give or receive a down payment gift April 8, 2021

- FHA Lowers Its Mortgage Insurance Premiums (MIP) For All New Loans January 26, 2015

- Shop for mortgage rates without lowering your credit score November 19, 2018

- Conventional Loan 3% Down Available Via Fannie Mae & Freddie Mac Apr 8, 2015

- Low-downward-payment mortgage options: iii% down mortgages for first-time dwelling house buyers March 11, 2021

- Do bi-weekly mortgage programs pay your mortgage down faster? September 18, 2018

- LTV explained: What is "loan to value" for a mortgage? July x, 2020

- 2022 VA Loan Residual Income Guidelines For All l States And The District Of Columbia January ii, 2020

- viii Ways To Go A Mortgage Approved (And Not Mess Information technology Up) May 26, 2016

- 4 ways to keep your mortgage closing costs low June 22, 2017

- USDA eligibility and income limits: 2022 USDA mortgage June 18, 2021

- Mortgage discount points explained January thirteen, 2022

- Y'all Don't Need A 20% Downpayment To Buy A Home February twenty, 2019

- Offset Time Domicile Buyer : The Early-2017 Guide to Buying a Home March ten, 2017

- Don't Have 20% To Put Downward? No Problem With These 5 Popular Mortgage Programs. March five, 2014

- USDA Abode Loans : 100% Financing And Very Low Mortgage Rates April 18, 2017

- Ownership A Dwelling With A Young man, Girlfriend, Partner, Or Friend July 17, 2016

The data contained on The Mortgage Reports website is for advisory purposes only and is not an advert for products offered by Full Beaker. The views and opinions expressed herein are those of the writer and do non reverberate the policy or position of Total Chalice, its officers, parent, or affiliates.

Source: https://themortgagereports.com/17354/mortgage-good-faith-estimate-guide

0 Response to "How to Read Mortgage Interest Rate Form"

Post a Comment